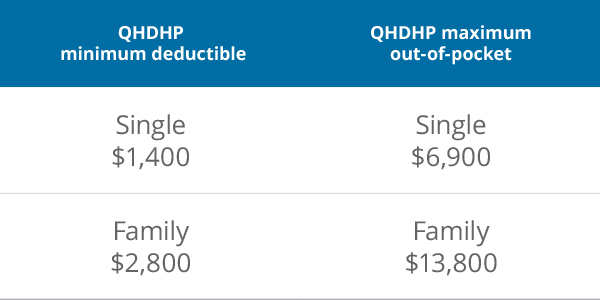

QHDHPs, or qualified high deductible health plans, are a type of insurance plan that has a higher medical deductible and typically costs less than a traditional health plan. Paired with a health savings account (HSA), these accounts can be used to help pay for higher out-of-pocket expenses. Each year, the IRS sets out-of-pocket limits, and the 2020 amounts are higher than 2019.

BCBSND will update the deductible and out-of-pocket maximums for our fully insured QHDHPs. For instance, a BlueSaver 80 2700 plan will be updated to a BlueSaver 80 2800. Clients with self-funded arrangements will need to confirm their deductible and out-of-pocket amounts when they renew.

Also, the U.S. Department of Health and Human Services (HHS) released the maximum out-of-pocket limit for HDHPs under the Affordable Care Act (ACA). ACA maximum out-of-pocket expenses for HDHPs:

- Single – $8,150 (increased from $7,900 in 2019)

- Family – $16,300 (increased from $15,800 in 2019)